There has been an increase of 20% in the YoY growth of Google search ad spending in Q3 2016, while paid search mobile phone spend has increased by 134% from the past year.

This is according to Merkle's Q3 Digital Marketing Report, which covers the latest trends in paid search, social media, display, and organic search.

Here are some more useful stats on all the changes that occurred in the past year.

Paid Search

- Google search ad spending grew 20% YoY in Q3 2016, although it's down from the 22% growth a quarter earlier. Click volume grew 28%, while CPCs fell 6%.

- Google Shopping (PLA) spending grew 36% YoY on a 59% increase in clicks. Google text ad spending rose 9% on 11% higher clicks.

- Bing Ads and Yahoo Gemini combined search ad spending fell 14% YoY in Q3 2016, compared to a 17% decline in Q2. Bing Product Ad spending declined 12%, while Gemini's share of click volume across both platforms remained flat at 17%.

- Total paid search phone spending increased 134% YoY, while both tablet and desktop spending fell 4%. Phones and tablets combined to generate 62% of Google search ad clicks, which is a 5% increase from Q2. Desktop CPCs rose 8% YoY in Q3 2016, while tablet CPCs were flat.

Organic Search & Social

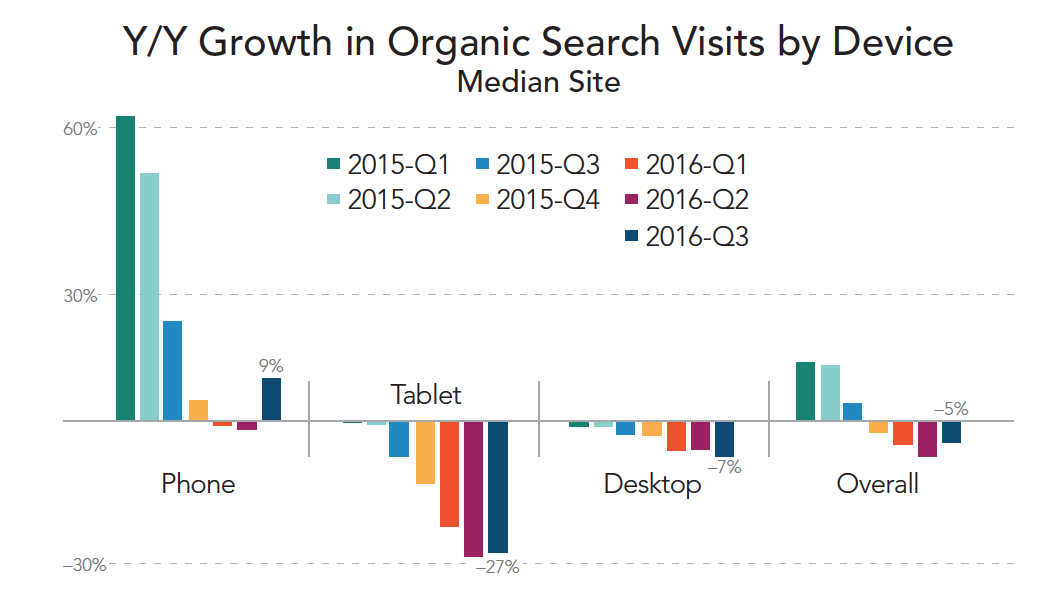

- Total organic search visits fell 5% YoY in Q3 2016, although still an improvement from a 7% decline in Q2. Phone organic search visits increased 9% YoY, the first quarterly increase in 2016, while desktop visits fell 7% .

- Google organic search visits fell 1% YoY as the search engine's efforts to increase the monetization of its mobile search results continues to depress organic volume. Yahoo organic visits fell 21% YoY, while Bing visits fell 2%.

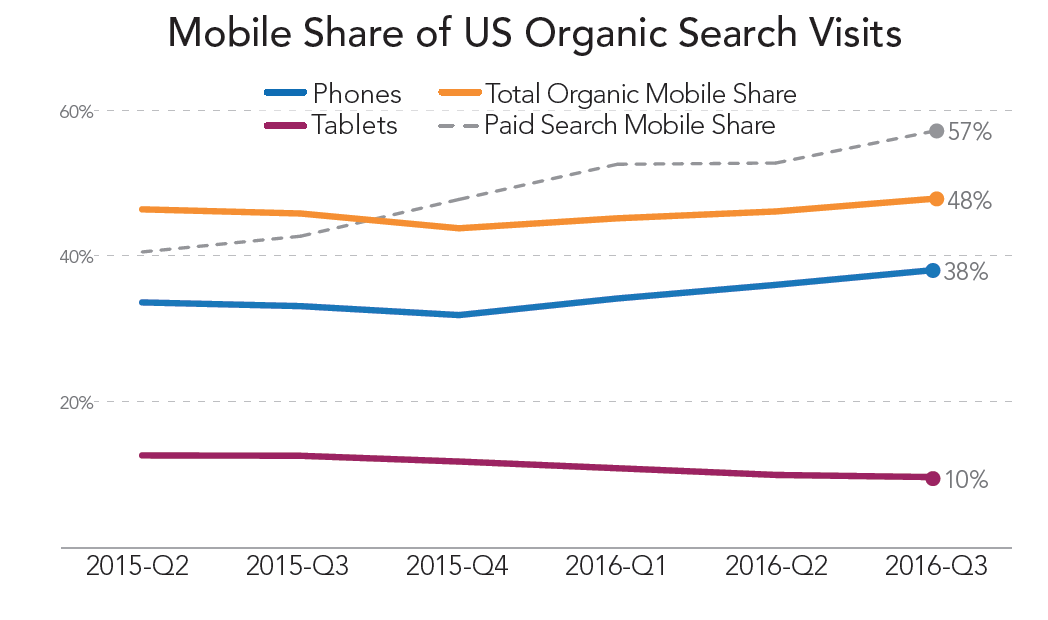

- Mobile devices produced 48% of organic search visits, up from 46% in Q2, but still below the 57% of paid search clicks that took place on mobile devices.

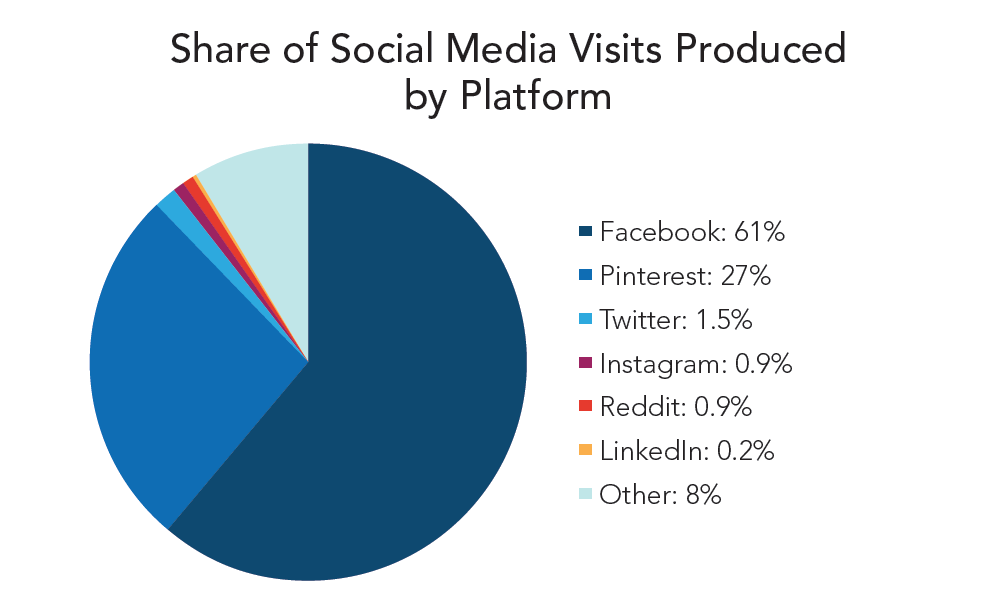

- Facebook dominated social visits, producing 61% of all site visits generated on social media sites in Q3 2016, which combined to produce 4% of mobile site visits.

Comparison Shopping Engines

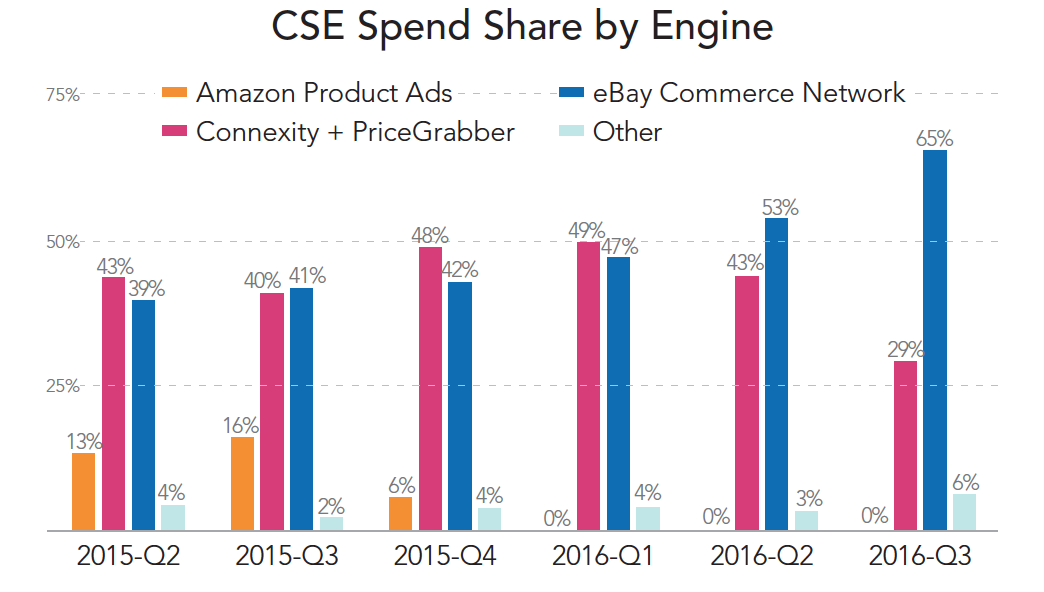

- The eBay Commerce Network's share of total comparison shopping engine (CSE) spending continued to climb, reaching 65% in Q3 2016. Niche CSEs account for 6% of spending, while eBay's main rival in this space, Connexity, has seen its share fall to 29%.

- Mobile devices produced just 16% of CSE clicks in Q3 2016, similar to the rate observed in Q2, but well below the over 60% rate for Google Shopping.

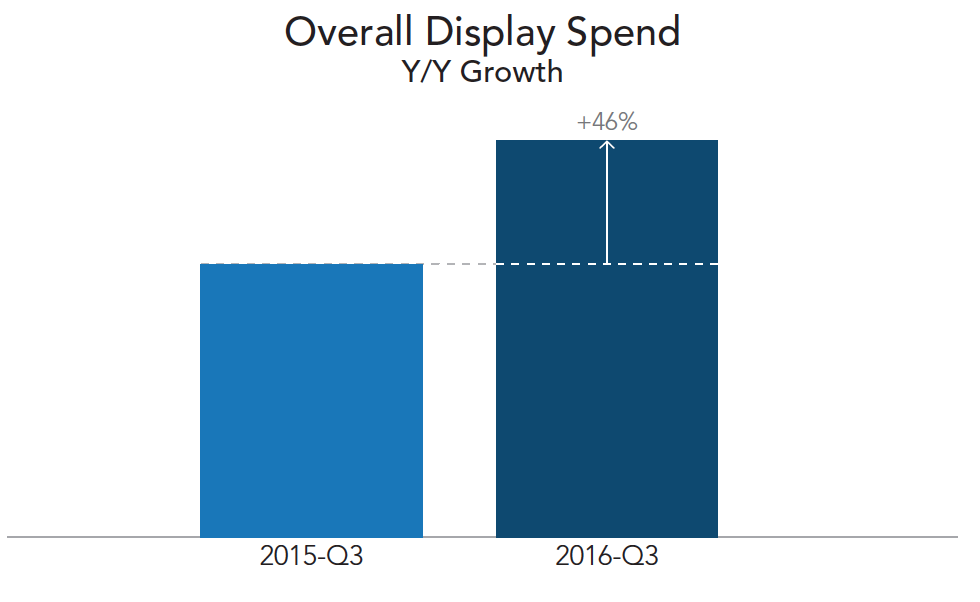

Display Advertising

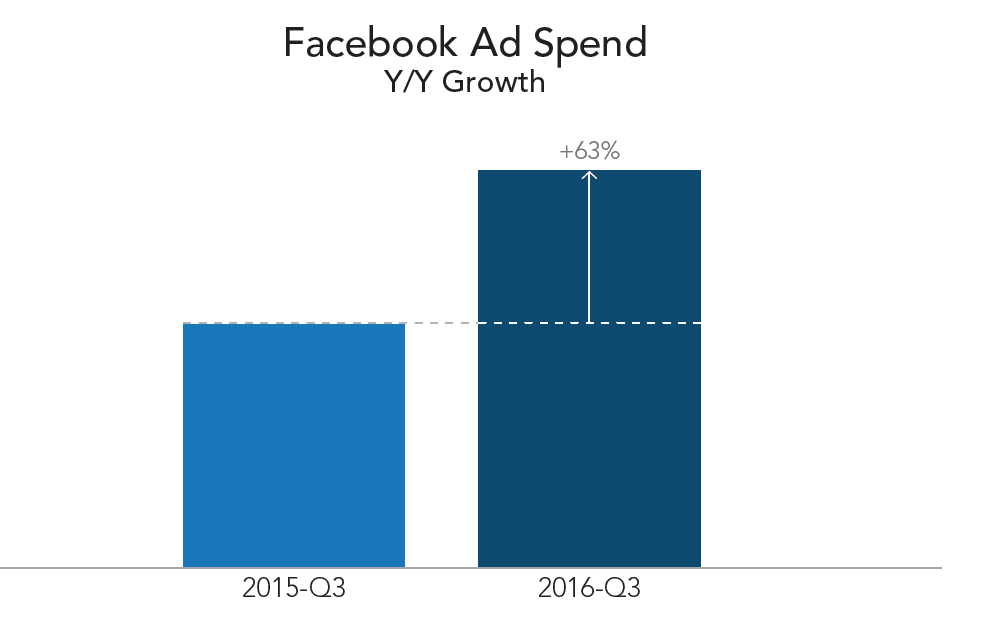

- Total display and paid social advertising spending rose 46% YoY in Q3 2016, with Facebook dominating with a 63% YoY increase. Facebook CPCs continued to decline YoY, although the average CPM rose 38%.

- The Google Display Network (GDN) accounted for 8% of advertisers' total Google advertising investment, a small decline from a year earlier.

- Facebook advertising spend was up 63% in YoY in Q3, which accounts for one of the highest rates of growth of the past years.

For more information check out Merkle's Q3 Digital Marketing Report.

No comments:

Post a Comment