Almost everyone knows that the overwhelming majority (93%) of online experiences begin with a search engine, but when you're looking to finish off your holiday shopping list, what search engine do you go to? Amazon or Google?

In 2012, a Forrester report found that 30% of all online shoppers start research products at Amazon. Wordtracker even went so far as to say that “Amazon has not only topped Google as the number one shopping search engine, but has attracted droves of individual and corporate sellers to its marketplace.”

Apparently, not much has changed since that time.

A recent study at the start of peak season for ecommerce has revealed that online retailer Amazon has taken a huge lead and become the first place consumers go to find products.

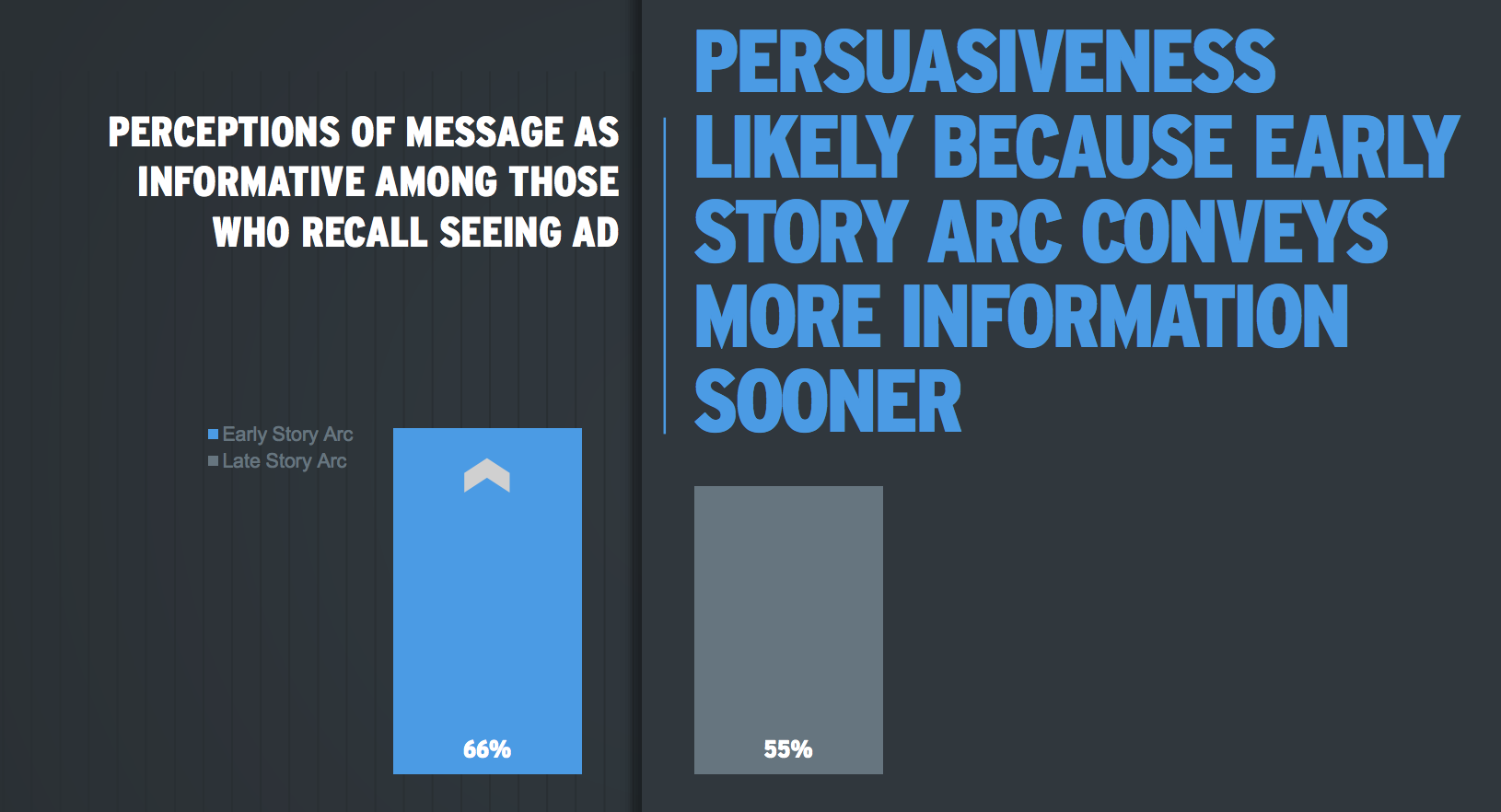

The study, run by personalization platform company BloomReach and Survata found that approximately 55% of customers use Amazon before any other site when searching for products online. This was the second annual “State of Amazon” study.

While the company's gains are impressive, it's nothing short of what consumers and researchers have come to expect from the retail giant.

In 2015, Amazon surpassed Wal-Mart as the most valuable retailer in the US, and its numbers only continue to grow. In the past, many more people would first turn to a search engine such as Google, but the number of services that Amazon offers puts the company at a distinct advantage for the coming holiday season.

The study

BloomReach's second annual “State of Amazon” study surveyed 2,000 U.S. consumers over the 2016 Labor Day weekend and revealed surprising results. While 55% of consumers reported going to Amazon before any other retailer, search engines and other retailers lost equal ground, pulling in only 28% and 16% of consumers, respectively.

The company's lead has only increased since BloomReach's inaugural “State of Amazon” study, conducted in 2015. BloomReach conducted a similar study in April, which revealed that Amazon already possessed 53% of consumers' first product search.

As it turns out, Amazon is involved in nearly all online shopping experiences. In fact, approximately 90% of consumers will conduct a search on Amazon even if the product they want is on another retailer's site.

“Amazon continues to be the first destination when consumers want to find a product, driven largely by a perceived superior end-to-end experience,” said Jason Seeba, BloomReach head of marketing. “Online shopping is all about relevance and convenience, and comparison shopping has never been easier – especially with mobile growth.”

The retailers

Amazon's grip on the public doesn't stop at general shopping, either. With the holiday season creeping upon us, the online retailer is expected to be the first destination for almost all online holiday shopping. Approximately 94% of consumers reported plans to complete their holiday shopping on Amazon, as well.

While retailers are feeling the pinch of Amazon's incredibly high consumer numbers, that doesn't mean they're entirely knocked out of the game. In fact, a majority of survey respondents said that other retailers were better at tailoring their websites and product recommendations.

Roughly one in five respondents reported that quality was their biggest concern while shopping at Amazon. It's relatively easy to buy some objects, but others face a high rate of counterfeit complaints.

In fact, the biggest complaints came from customers who used Amazon's relatively new “marketplace” feature. In an effort to compete with Etsy, another online retailer, Amazon created a third-party space for consumers to interact in much the same way they do on Etsy.

However, the growing artisan community came into Q3 2016 with a strong lead over Amazon's Marketplace.

Wal-Mart

Amazon may have some fierce competition online from the Etsy artisan community, but other retailers are struggling with their ecommerce for the holiday season.

Wal-Mart in particular is making a big push to expand their online presence as holiday season creeps ever closer.

However, investors are still looking for proof that the payoff will be worth all of the time and money in the end. The company stated that it plans to spend approximately $11 billion in its next fiscal year on ecommerce initiatives while still focusing on remodeling its stores.

Wal-Mart, while its ecommerce spending might be alarming, isn't new to this type of investment. In fact, its US online sales are second only to Amazon, the company it's currently attempting to surpass.

As one of the most successful brick-and-mortar franchises in the nation, Wal-Mart certainly doesn't have anything to fear as far as holiday sales go. The biggest issue for the company is whether its investors will see the current ecommerce spending necessary to compete with Amazon.

The shoppers

Whether it's brick-and-mortar retail shopping or it begins on a search engine, holiday creep has arrived. In fact, by the time Labor Day rolled around this year, nearly half of American parents had already started their holiday shopping.

Retailers like Macy's and Best Buy have already started their holiday advertising campaigns, even going so far as to deck out their stores in red and white holiday garb.

According to data from last year's Rubicon survey, only 42% of parents had started their holiday shopping by September. This year marks a significant increase in their data, although other studies reveal that Rubicon's numbers may run a bit high.

According to a CreditCards.com report from 2015, only about 14% of American consumers had started thier holiday shopping by September. However, their most recent survey showed the same upward trend in those consumers choosing to shop earlier in the year.

American parents are expected to spend approximately $1,711 during the 2016 holidays, according to Rubicon. And as the BloomReach survey suggests, most of them will be headed to search engines and Amazon for their initial searches.

According to the BloomReach “State of Amazon” study, when holiday shoppers have an idea of what they want, 59% will start on Amazon and 24% will start on a search engine. However, even a Google search is likely to direct consumers to Amazon before any other retailer.

Amazon's presence in the e-commerce community hasn't gone unnoticed by consumers, either. In fact, one in five consumers revealed they were concerned about the company's dominance relative to other retail outlets.

In conclusion

Amazon, while a powerhouse in the ecommerce community, still has a few issues of its own to work out. For one, its artisan-only Marketplace doesn't offer the kind of authenticity and service that sites like Etsy do. Consumers are not only concerned with counterfeit products, but with the company's dominance over the online community.

Nevertheless, the company hasn't pushed search engines or other retailers completely out of the holiday shopping game. A good chunk of consumers still turn to search engines before they conduct an Amazon search, although most search engines direct them to Amazon before other retailers.

Holiday shopping season has arrived, and although Amazon has its faults, 53% of consumers still report having left another website in favor of Amazon. This year's holiday shopping trends just may mark a huge milestone for the company.